FAQ

What is Reasonable Compensation?

See the US Department of Labor’s Bureau of Labor Statistics Survey: https://www.bls.gov/bls/blswage.htm

What is the IRS Processing Now?

Want to know where your correspondence or return is in the IRS processing queue? Check here: https://www.irs.gov/help/processing-status-for-tax-forms

2020 Unemployment Compensation Exclusion Refund

CO DOR (Department of Revenue) lost a lawsuit about having to add back the CO Unemployment to the CO returns in 2020 because of the federal retroactive tax law change in March 2021. See the CO DOR announcement and the CO DOR 2020 Unemployment Compensation Exclusion instructions If the taxpayer has, or creates, a CO DOR account they can amend their 2020 return before May 17, 2025 for free to get their refund of up to $464 per unemployed person.

File your Income Taxes for Free with the IRS or VITA

If your income is less than $79,000 you can file your federal tax return for free at https://apps.irs.gov/app/freeFile. You can also file a CO return for free using the CO Department of Revenue’s Revenue On-line. See https://www.colorado.gov/revenueonline/_/ Simple returns would be W-2s interest statements, and possibly Social Security payments.

The folks with the IRS VITA (Volunteer Income Tax Assistance) Income Tax Sites along with the Mile High United Way’s Tax Help Colorado and other local non-profits can help file your tax returns for free. See https://irs.treasury.gov/freetaxprep/ for this year’s locations.

For example, a couple with only Social Security has no federal taxable income, but needs to file a tax a CO tax return to get the Tabor refund. Children and students generally cannot claim themselves as they are dependents of another such as their parents. When there are child and/or education credits to be considered it may be wise to seek professional support to preserve the best option for all involved.

At All Win Tax & Bookkeeping our prices typically start around $250, but many returns range from $500 – $1,500 depending upon what needs to be reported. We bill by the form, and provide tax planning all year. There are many useful worksheets and summaries at our Tax Resources tab.

2024 Payroll Changes

For our Payroll clients we are verifying these changes for 2024

- CO Unemployment Rates are correct for 2024

- CO Family Leave deductions are in place – click next headline for all the pertinent info

- CO Secure Savings registrations are in place

CO Family Leave Act Starts Payroll Contributions January 1, 2023

GAO Report to Congress on Sales Tax, November 14, 2022

Click here for the latest word on IRS Processing Delays

Some 2019 & 2020 Late Filing Penalties to be Abated Proactively by IRS

Some (not all) penalties for late filing and late paying of some types of 2019 & 2020 tax returns that can be abated with a phone call from the taxpayer or the tax return preparer with a Power of Attorney will now be proactively abated by the IRS.

See https://www.irs.gov/newsroom/help-for-taxpayers-and-tax-professionals and the nitty gritty is at https://www.irs.gov/pub/irs-drop/n-22-36.pdf

Tax Exempt Organizations at the IRS

CO delays Sales Tax Destination Sourcing for Gross Revenues Less Than $100,000

Governor Polis signed SB21-282 on June 30, 2021, which extends the small business exception to destination sourcing requirements. This exception applies only to businesses with less than $100,000 in retail sales. Beginning February 1, 2022, all retailers will be required to apply the destination sourcing rules.

All US Residents need to file tax returns

If you live in the US and earn income (legally or illegally) you must file a tax return in most all cases. The IRS considers non-US citizens to be “aliens”, which is just a legal term. Some resident aliens with valid work visas will qualify for a Social Security Number. Other resident aliens can get an ITIN (Individual Taxpayer Identification Number).so that they can file tax returns. See IRS Publication 4327. We can file the needed W-7 form with the first tax return to get the ITIN.

Password Protect your LLC at the Colorado Secretary of State

By the way have you secured access to your LLC records by adding a password to your account at the Colorado Secretary of State? If not, today should be your day to do so, https://www.sos.state.co.us/…/ProtectYour…/secureFiling.html

Password Protect your Social Security Number at ssa.gov

Have you password protected your Social Security number yet at ssa.gov? Whether you are a new born or 101, today would be a good day to do so at https://www.ssa.gov/myaccount/. Passwords should be more than 10 characters long to avoid being by hacker tools in less than a couple of hours.

Thinking about Solar & Related Tax Credits?

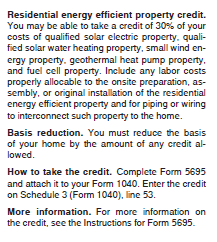

For 2019 there is a non-refundable residential energy credit of 30% of the cost (less in future years), but if you cannot use the whole credit it can carry forward until used. For example, if the solar panels & electrical connection costs (including labor) is $10,000; that means a tax credit of $3,000 on your federal taxes.

In addition, Xcel Energy has a rewards program for the owner of the solar system, so make sure you aren’t leasing the solar system. See more here.

Apparently for residential customers they have discontinued the buy-back of extra energy option, but there is a net metering option.

Colorado lacks a credit for solar, but the energy office has good info: https://www.letsgosolar.com/

On page 240 of IRS Publication 17, https://www.irs.gov/pub/irs-pdf/p17.pdf, is the short note.

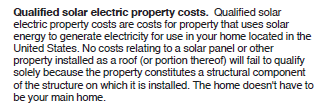

The Form 5695 Instructions further qualify:

We should probably redo your tax plan if you choose to add this to your house once you have the final cost numbers.